Dubai, An important money hub in the center East, provides a variety of accounting and tax expert services tailored to satisfy the desires of companies and people today. Regardless of whether you happen to be trying to find accounting Dubai, accounting & bookkeeping Dubai, or have to have aid with CFO services, comprehending the neighborhood tax rules and corporate tax needs is vital. This guidebook gives an overview of Dubai tax, taxes in Dubai, and essential services such as registering for company tax and VAT.

1. Accounting Dubai: Professional Financial Administration

Accounting Dubai encompasses various companies created to make sure exact money management and compliance with local restrictions. Essential solutions include:

Money Reporting: Getting ready and presenting financial statements that mirror the organization’s economical placement and overall performance.

Bookkeeping: Recording daily transactions, handling accounts payable and receivable, and reconciling bank statements.

Payroll Administration: Processing employee salaries, Added benefits, and making certain compliance with labor guidelines.

Selecting the suitable accounting company in Dubai may help streamline your monetary operations and be certain regulatory compliance.

2. Accounting & Bookkeeping Dubai: Thorough Solutions

Accounting & bookkeeping Dubai companies are important for maintaining correct money documents and ensuring easy small business functions. These products and services normally incorporate:

Day by day Bookkeeping: Recording all monetary transactions, which includes profits, buys, and fees.

Financial Evaluation: Analyzing economic knowledge to guidance conclusion-earning and strategic planning.

Tax Compliance: Ensuring that all tax-related transactions are accurately recorded and reported.

Effective bookkeeping and accounting solutions assist companies handle their funds competently and stay compliant with local polices.

three. CFO Companies Dubai: Strategic Economic Leadership

CFO services in Dubai deliver strategic money leadership and assistance for businesses. These expert services typically contain:

Monetary Planning and Investigation: Building monetary procedures and forecasts to information company conclusions.

Threat Administration: Figuring out and mitigating financial pitfalls.

Company Governance: Ensuring adherence to money rules and best methods.

Engaging a CFO provider in Dubai can offer beneficial insights and oversight for running sophisticated economical operations and obtaining extensive-phrase aims.

four. Dubai Tax: Comprehending Community Taxation

Dubai tax refers back to the numerous tax rules and prerequisites applicable in Dubai. Important factors involve:

Company Tax: Dubai has introduced a corporate tax regime productive from June 2023, with a standard rate of 9% on income exceeding AED 375,000.

VAT (Price Extra Tax): Executed in a level of five% on most merchandise and services, VAT registration is mandatory for companies with taxable supplies exceeding AED 375,000 each year.

Excise Tax: Applied to certain items including tobacco and sugary drinks.

Knowing Dubai’s tax program is essential for ensuring compliance and optimizing tax methods.

five. Taxes in Dubai: Vital Considerations

Taxes in Dubai generally involve:

Company Tax: Applicable to organizations primarily based on their own gain amounts. Registration for corporate tax is necessary for all qualifying entities.

VAT: Impacts businesses and individuals, necessitating organizations to collect and remit VAT on taxable materials.

Excise Tax: Targets certain goods and is built to discourage the usage of dangerous merchandise.

Trying to keep abreast of the latest tax restrictions and updates is vital for maintaining compliance and preventing penalties.

6. Registering for Company Tax Dubai: Important Ways

Registering for corporate tax in Dubai will involve tax in Dubai many steps:

Establish Eligibility: Evaluate if your online business satisfies the criteria for company tax registration.

Post Documentation: Present essential paperwork, which include organization registration facts and financial statements.

File Tax Returns: Frequently file corporate tax returns and pay back any taxes due.

Suitable registration and adherence to company tax regulations aid corporations steer clear of authorized troubles and economical penalties.

seven. Company Tax Dubai: New Regulations and Needs

Corporate tax in Dubai introduces new rules that companies will have to adhere to, including:

Tax Price: A 9% tax charge applies to income exceeding AED 375,000.

Compliance: Firms ought to manage exact documents, file tax returns, and ensure well timed payment of taxes.

Exemptions: Sure sectors and activities might be exempt from corporate tax less than unique conditions.

Being educated about these restrictions will help firms navigate the tax landscape effectively.

8. VAT Dubai: Essential Information

VAT Dubai will involve:

Registration: Organizations with taxable supplies exceeding AED 375,000 must sign up for VAT.

Costs: A typical rate of five% is applied to most merchandise and expert services, with some exceptions.

Compliance: Companies must cost VAT on their gross sales, file VAT returns, and remit collected VAT to the Federal Tax Authority (FTA).

Being familiar with VAT necessities guarantees that companies control their tax obligations efficiently.

Summary

Navigating the complexities of accounting and tax solutions in Dubai involves a thorough comprehension of nearby polices and obtainable products and services. No matter whether you'll need accounting Dubai, accounting & bookkeeping Dubai, or specialized CFO products and services, selecting the suitable experts will let you handle your money affairs effectively. Moreover, being educated about Dubai tax, corporate tax, VAT, and registering for corporate tax is essential for guaranteeing compliance and optimizing economical administration. By leveraging these solutions and methods, you could achieve monetary good results and regulatory adherence in Dubai’s dynamic organization natural environment.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Michael Bower Then & Now!

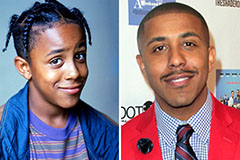

Michael Bower Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Kane Then & Now!

Kane Then & Now!